Some Fed watchers are urging the central bank to do something it rarely does. lower interest rates outside of regularly scheduled policy meetings.

The Fed has done this before, but usually during times of extreme crisis. 2020 global pandemic. The financial crisis of 2008. The Black Monday market crash of 1987.

Calls for the Fed to do so grew louder Monday ahead of its next meeting on Sept. 17-18, amid the stock market’s worst one-day decline since 2022.

“There is a strong case for action through September,” JPMorgan chief economist Michael Feroli said in a research note.

The central bank last week decided to keep interest rates at a 23-year high, while hinting that the first cut could come at its regularly scheduled meeting on September 17-18 if data supports such a move.

The Fed appears to be “materially behind the curve,” added JPMorgan’s Feroli, who expects a 50-basis-point cut at the September meeting, followed by another 50-basis-point cut in November.

Other Fed watchers urged calm, noting that an emergency Fed move ahead of Sept. 17-18 could actually cause more panic in markets that regained composure on Tuesday.

“It’s incredible to hear that people are calling for a break in meetings,” Mohamed El-Erian, Allianz’s chief economic adviser, told Yahoo Finance on Monday. “It’s not going to happen.”

The last time the Fed cut rates between meetings was in March 2020, when the Covid-19 pandemic hit and shut down the economy. It caused one of the sharpest and shortest recessions in history.

Before the pandemic, there were emergency layoffs in the wake of the financial crisis in 2008 and 2001, after the tech bubble burst and the 9/11 terrorist attacks.

Earlier emergency cuts followed the October 1987 stock market crash, the early 1990s recession and the 1998 collapse of hedge fund Long-Term Capital Management.

There is no doubt that pressure on the Fed to cut interest rates is now mounting after last Friday’s weak jobs report raised fears of a recession. Data from the Bureau of Labor Statistics released last Friday showed the unemployment rate at its highest level since October 2021.

Wall Street is now pricing in a half-percent rate cut in both September and November, and another quarter-point cut in December. Traders had previously been looking at two quarter-point cuts for the rest of this year.

But Wilmer Stith, bond portfolio manager at Wilmington Trust, said that doesn’t mean the Fed will decide to do anything before its September meeting.

“If things continue to fall out of bed at the rate that they seem to be falling, anything is possible,” he said, “but I think it’s unlikely that they’ll carry over to intersession because I think it will just represent more fear. the store.”

Hedge fund manager James Fishback is in the same camp, saying the Fed won’t overreact based on a single sluggish jobs report.

Another reason Fishback believes the Fed won’t act between meetings is politics.

The emergency cuts would suggest a real crisis that could hurt Vice President Kamala Harris’ electoral chances and open a line of attack for former President Donald Trump. Fishback claims the Fed is largely made up of Democrats.

“The Fed’s undeniable policy leanings reduce the likelihood of emergency rate cuts and/or aggressive rate cuts,” he said.

“I doubt politics will be the main factor in determining the size of the September rate cut, but in a close meeting, politics could certainly play a role.”

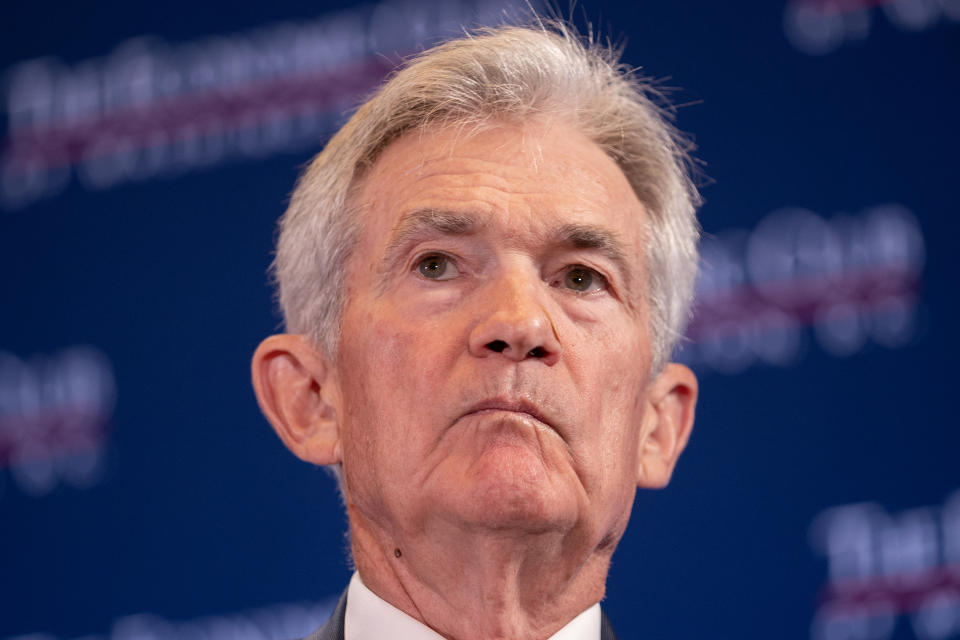

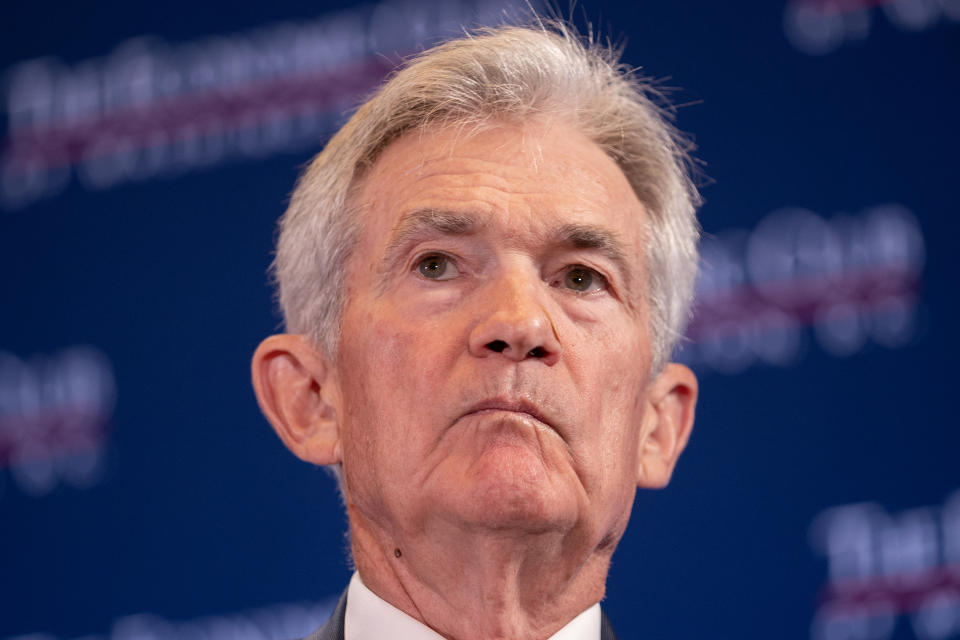

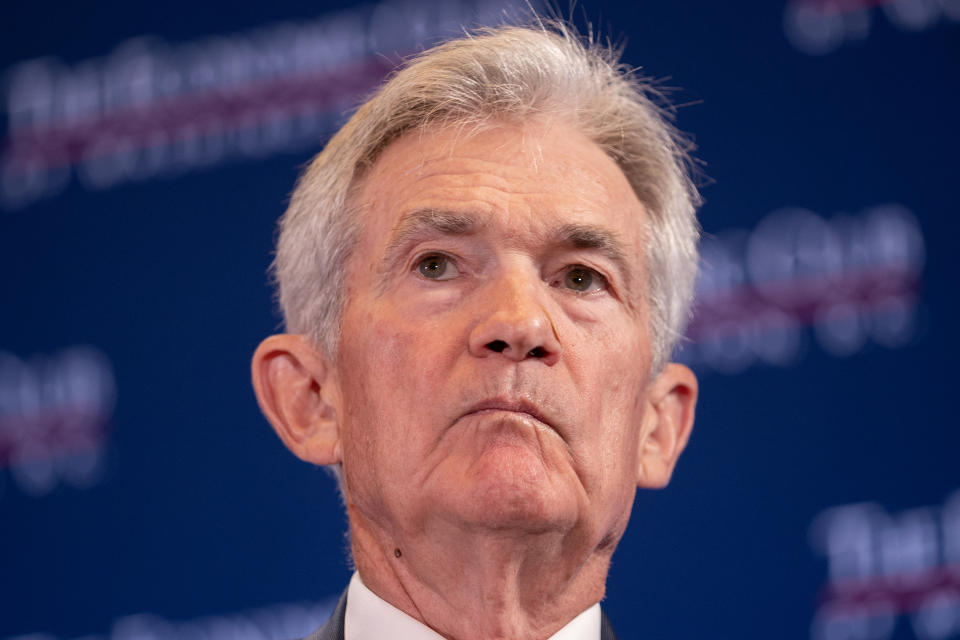

Powell insists the central bank will remain apolitical as the Fed considers cutting interest rates at upcoming meetings, stressing that the only benchmarks it considers will be data on prices and jobs.

Last week, he dismissed the idea of a 50-basis-point cut when asked about it at a news conference, making a 25-basis-point cut more likely for September if the Fed decides to act.

“I don’t really want to be specific about what we’re going to do, but that’s not what we’re thinking about right now,” Powell said at a news conference. “Of course, as of today, we have not made any decisions at all.

Powell will have another chance to express his thoughts on the path of monetary policy when he speaks at the Fed’s annual conference in Jackson Hole, Wyo., in about two weeks.

Click here for an in-depth analysis of the latest stock market news and events that move stock prices

Read the latest financial and business news from Yahoo Finance